How can you make the most of the grants in your RESP?

Optimize your contributions

Investing in a Registered Education Savings Plan (RESP) is an excellent way to finance your child’s education and help them reach their full potential.

With strategic contribution planning, you can:

- grow your capital;

- make the most of available government grants;

- achieve your financial goals with confidence;

- get the best return on your investment.

Find out how to make the most of your RESP without leaving money on the table.

Discover Kaleido RESPs

I’m already a customer

What are the advantages of putting the maximum into an RESP?

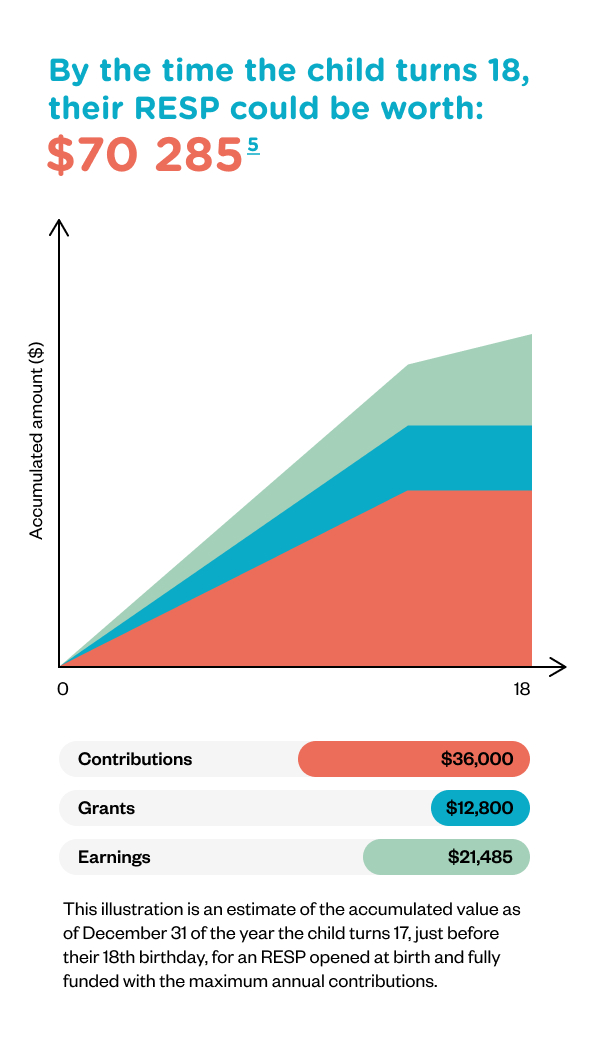

To take full advantage of the government grants available with an RESP, it is recommended that you contribute $2,500 per year.1 Contributing this amount annually allows you to take full advantage of RESP benefits, year after year. With a well-planned strategy, your child could receive up to $12,8002 in post-secondary education grants!3

There is no annual contribution limit as such, but only the first $2,500 paid each year is eligible for government grants.

It is also possible to recover unused grants from previous years.4 However, it is often more advantageous to make regular contributions, as this ensures stable, ongoing growth of your savings.

Finally, keep in mind that the lifetime contribution limit for any beneficiary is $50,000, regardless of the number of RESPs opened in their name.

.

.

Up to what age can you apply for grants?

In principle, it is possible to get grants by contributing to an RESP up to December 31 of the year a child reaches age 17. However, you will need to have contributed a certain amount by December 31 of the year in which they turn 15 to still be eligible for grants all the way through, i.e., you will have to have contributed:

- $100 per year for 4 years;

or

- at least $2,000.

This rule applies to all RESP providers across Canada. That said, opening an RESP for your teen can be very advantageous, thanks in part to the ability to recover retroactive entitlements.

The easiest way to find out if your young person is still eligible for grants is to let our tool guide you to the right answer! Play the game to see if this rule applies to you.

How much could your RESP actually earn?

Get the results in a few seconds!

What’s the difference between “maximizing an RESP” and “maximum contributions”?

Maximizing your RESP means getting the best return on your RESP investment by implementing the best strategies for making your savings grow.

Maximum contributions are the annual amounts that you should not exceed if you want to avoid going over the lifetime contribution limits.

What happens if I exceed my RESP contribution limit?

If, at the end of any month, total RESP contributions exceed the lifetime contribution limit (i.e., $50,000 per beneficiary), you will be taxed 1% per month on the amount of the excess contributions. For example, if you have contributed $53,000 to your RESP, the excess contribution of $3,000 will be taxed at $30 per month until it is withdrawn. To avoid this, it’s best to withdraw any excess funds before the end of the month.

Note that government grants paid into an RESP are not included in the contribution limit. So you won’t be penalized if your RESP exceeds the $50,000 limit only because of growth and grants, not because of excess contributions.

INTERESTING!

Contributions to an education savings plan grow tax-free until your child turns 17 and enrols in an eligible post-secondary program.3

Monthly or annual RESP contributions?6?

You can choose annual contributions, but make sure you put the maximum into your RESP by December 31 of each year to take full advantage of government grants.

If your family income allows, you can make monthly contributions, particularly by scheduling automatic payments; this will help you keep saving steadily and give you a better chance of reaching the maximum annual contribution amount that qualifies you for the government grants you’re entitled to. With monthly contributions, you’ll also reap the benefits of compounding, which generates interest on interest.

Want to learn more about strategies for maximizing your RESP?

Discover Kaleido RESPs

I’m already a customer

1. Any amount invested in excess of $2,500 will not attract any government grants unless you have unused grant contribution room. Some conditions apply. Check out our prospectus at kaleido.ca.

2. Canada Education Savings Grant (CESG) of 20% to 40% and Québec Education Savings Incentive (QESI) of 10% to 20%, based on adjusted family net income. The maximum annual CESG payment is $600, and the maximum annual QESI payment is $300. The maximum lifetime amount per beneficiary is $7,200 for the CESG and $3,600 for the QESI. Canada Learning Bond (CLB) of up to $2,000 per beneficiary for a child born after December 31, 2003, whose family is financially eligible. Some conditions apply. Check out our prospectus at kaleido.ca.

3. See our prospectus at kaleido.ca for a list of eligible post-secondary programs.

4. If you have unused grant contribution room, government grants can be accumulated on contributions of up to $5,000 per year. Some conditions apply. Check out our prospectus at kaleido.ca.

5. Suggested amounts are based on enrolment in the IDEO+ Evolution RESP. The information presented is for illustrative purposes only and does not guarantee the future performance of IDEO+ plans. The amounts shown have no legal value and depend on the total duration of the investment in an IDEO+ Adaptive plan and the age of the beneficiary. Calculations are based on a beneficiary aged 0, born on January 1, 2025, whose RESP is opened at birth fully funded with the maximum annual contributions. Please refer to our prospectus at kaleido.ca for applicable conditions.

6. See our prospectus at kaleido.ca for information about contribution options.